corporate finance payment method during merger and acquisition

Find a companys annual report. We use different econometric methodologies to measure the probability of the choice of payment method and we find that.

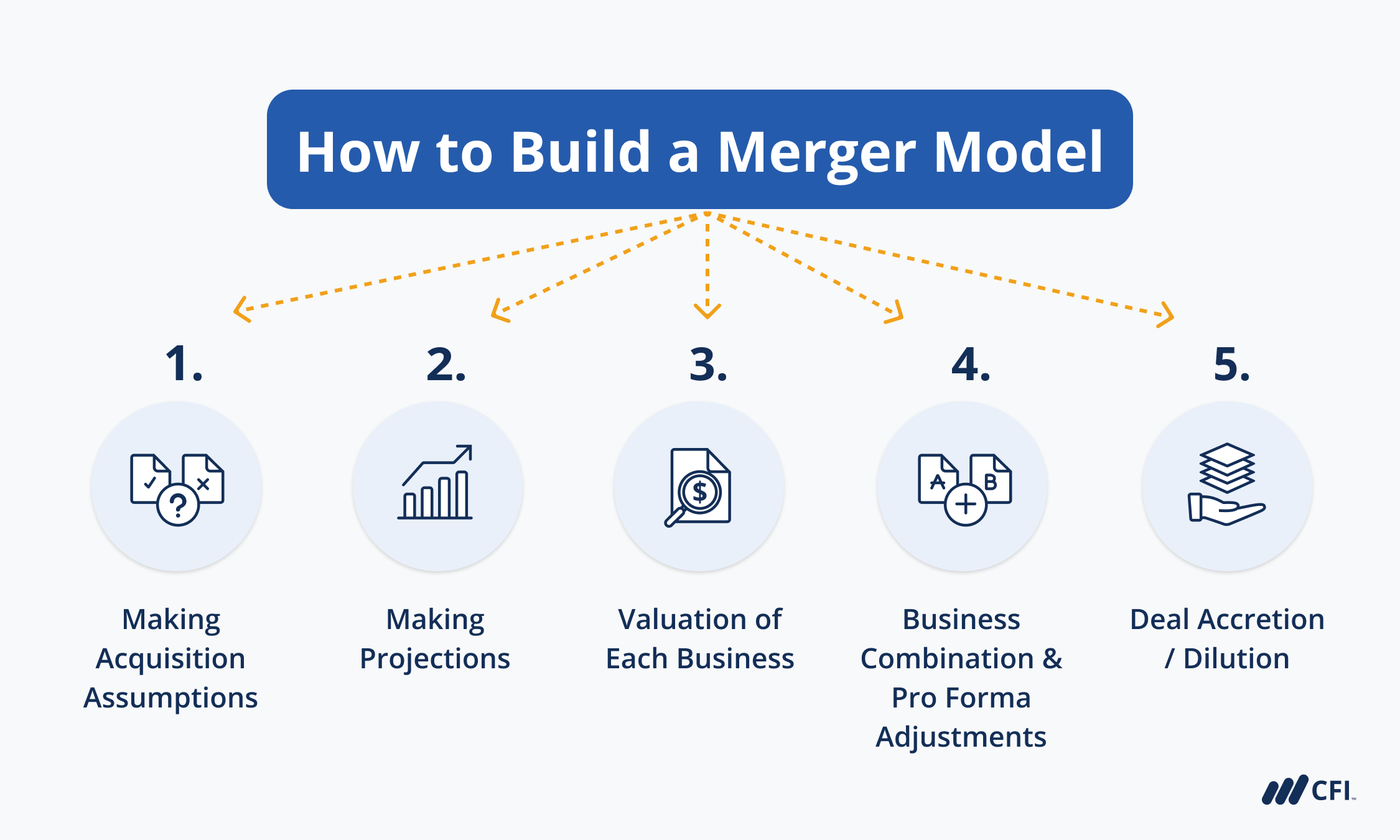

How To Build A Merger Model A Basic Overview Of The Key Steps

Our services focus on corporate transactions in the sale of businesses and acquisition of companies.

. Analysis of a merger or an acquisition. Credit ratings and the choice of payment method in mergers and acquisitions Journal of Corporate Finance Elsevier vol. Acquirer managerial ownership is not related to the probability of stock financing.

In a typical stock-exchange transaction the buyer will exchange shares in their own company for shares in the selling company. Provide an introduction to the companies. You may choose any recent merger or acquisition within the last 5 years.

Initial Public Offering An initial public offering is the greatest method for a company to acquire cash at any time but an approaching merger or acquisition is an excellent moment to put the process in place. Methods of Payments Cash Share Exchange Cash Underwritten Share Debentures Convertible Loan or Preference Shares Deferred Payment AG 8. Acquirers recent stock price performance.

Mergers and Acquisitions MAs have been a global phenomenon in corporate world yet there is still scope to broaden our current understanding on the subject including the choice of payment. Corporate Finance Mergers Acquisitions Capital structure for corporations is a key element in how a companys management attempts to maximize shareholder value. MA is the general term used to describe a consolidation of.

This works best where the seller is already considering an exit and is relatively flexible on payment terms. Financing MA with stock is a relatively safe option as both parties share risks between the two of them after the transaction meaning that careful management is guaranteed. Determinants of the method of payment in mergers and acquisitions The Quarterly Review of Economics and Finance Elsevier vol.

I The likelihood of a cash offer or fraction of cash used as payment method in the takeover bid is not significantly associated with bidder credit rating existence. Analyze the success of the merger or acquisition. 504 pages 471-484 November.

This article examines the motives underlying the payment method in corporate acquisitions. In addition they no longer have to worry about the future performance of their company. There is a significant post acquisition decline in the degree of operating leverage for mergers.

Stock payment method is a non-cash payment method in which acquiring companies issue own equity share to target company as purchase consideration of the deal. Mayer W and Walker M. It is particularly appreciated by shareholders who are unable to sell their stock by other means which is the case for most privately-held companies.

Ismail Ahmad Krause Andreas 2010. We have a team of professionals with extensive experience in executing and negotiating MAs and we advise you and see you through the entire process. The findings support the notion that the higher the acquirers growth opportunities the more likely the acquirer is to use stock to finance an acquisition.

Explain based on industry life cycles the relation between merger motivations and types of mergers. Contrast merger transaction characteristics by form of acquisition method of payment and attitude of target management. Mergers and industry life cycle d.

I was wondering what is the average accepted GPA to move onto the next round of interviews for a F500 Company ranking in 300-500 from a top 25 school. An empirical analysis of the choice of payment method in corporate acquisitions during 1980 to 1990. Factors Affecting Choice of Financing Method for MA Acquirers liquidity position.

The financing decision also affects an acquirers ownership structure financial leverage and subsequent decisions. Paying for an Acquisition With Cash. The completed project should include the information listed below.

Many considerations must be weighed as firms settle on the mix of debt equity and other sources of capital on their balance sheets. The positive likelihood of using cash as a method of payment in acquisitions in which firms have high credit quality can be considered as a high value asset for bidders shareholders given the well-documented fact that cash consideration is related with various beneficial outcomes for shareholders of bidding firms such as favorable valuation effects and. In the capital structure of a company mezzanine finance is a hybrid between equity and debt.

The benefit of an earnout to a seller is that most or in some cases all of the transaction fees that you pay are contingent on the firms ongoing success. The payment method provides a candid assessment from the acquirers perspective of the relative value of a companys stock price. The full sample of mergers also shows an increase in the intrinsic business risk during the same period controlling for method of payment does not change the results.

Evaluation of a Merger or Acquisition. We offer companies advice on Mergers and Acquisitions in the national and international arenas. Ii The likelihood of a cash offer or fraction of cash used in the acquisition bid has a strong.

The form of payment generally preferred by the shareholders of the acquiree is cash. An earnout is one of the most creative ways to finance an acquisition. Corporate Finance Development and Strategy Forum CF.

Monkey 47. Findings This paper finds that many merger and acquisition MA outcomes target and acquirer announcement returns acquirer long-run returns premiums and the method of payment are. The acquiring company can pay the target company through methods such as cash stock swaps debt mezzanine financing Mezzanine Fund A mezzanine fund is a pool of capital which invests in mezzanine finance for acquisitions growth recapitalization or managementleveraged buyouts.

May 11 2014 May 11 2014.

5 Tips For Hr During Mergers Acquisitions Infographic Agile Project Management Infographic Marketing Educational Infographic

Why Companies Go For Mergers And Acquisitions Management Guru Infographic Marketing Strategy Infographic How To Plan

M A Process Steps In The Mergers Acquisitions Process Merger Process Transaction Cost

Mergers Acquisitions Consulting Merger Acquisition Consultants M A Business Strategy Management Merger How To Plan

A Brief Infographic I Made To Walk You Through The Process Of M A Target And Prospecting Business M A Mergers Acquisi Business Business Development Merger

M A Process Steps In The Mergers Acquisitions Process Merger Process Knowledge

Mergers And Acquisitions Advisory Merger Buy And Sell Business Business Assistance

Mergers Vs Acquisitions Financial Life Hacks Financial Literacy Finance Investing

M A Process Steps In The Mergers Acquisitions Process Merger Marketing Plan Template Business Resume Template

Komentar

Posting Komentar